Despite the restless jail-break, wanderlust tendencies of my teens as a bored student, I actually ended up going back to school / university several times in my life: 1996-2000, 2003-4 and 2007-10. 8 years and several degrees later, I was finally “educated”. Also, I emerged without any debt. Miracle? No. Canadian? Yes. Now, if I were to keep my family’s  sort-of middle class-ness a constant, and if I were an American, all this schooling would have probably required tens of thousands in student loans. But, it didn’t. I did this in Canada, where one year’s tuition at a “good” university was about $3,500—(the price has gone up since, to much resistance). Books, another $1,000. Also, I chose to live at home, trading my sanity for free meals and rent-lessness. (Thinking back, I should have probably negotiated way harder…)

sort-of middle class-ness a constant, and if I were an American, all this schooling would have probably required tens of thousands in student loans. But, it didn’t. I did this in Canada, where one year’s tuition at a “good” university was about $3,500—(the price has gone up since, to much resistance). Books, another $1,000. Also, I chose to live at home, trading my sanity for free meals and rent-lessness. (Thinking back, I should have probably negotiated way harder…)

Summer jobs and light part-time work during the year paid off my expenses mostly. I worked at a department store selling latent hip-hoppish over-sized jeans to man-boys and catching the odd shoplifter in the fitting rooms. I was also a mascot at video trade shows and a secret shopper. As well, trawling for obscure scholarships managed to bring in some fish—one year, a fluke scholarship netted $2,500! I thought it was a memorial scholarship, but it turned out the benefactor was NOT dead. I remember writing him a late thank you letter like, “Dear Mr. ______, I’m so ashamed I hadn’t written sooner. For some reason, I thought you were dead.” Luckily, he wrote back, “Ha ha!”

As well, in my case, I refused financial help from my parents as I tacitly understood that was code for: mind control. (Strangely, that I was living at home eating their food and taking up space was different–even a “favour” to them culturally. Don’t ask.)

Also, I was deemed “ineligible” for student loans because apparently, I had “too much money” at my disposal!! After I wrote a polite letter asking the loan office to justify why it was they thought I was rich, they cited a credit card that I had access to and that I had used it to buy a car! Well, all that was true, but it was my dad’s persuasion for me to take advantage of the student discount (a campaign by the credit card company) on some new GM model at the time. In that case, the car payment obviously came from him because the car was HIS. And at most I got to drive the car sometimes to go “clubbing” (night not baby seal) in the Canadian winters—it was the only way to participate in the mass cultural delusion that it is at all possible to be fashionable in the cold; an abject denial that cocoon-animal-hide-blubber insulation was truly the only physiologically sound way make it to Thursdays Ladies’ Night. But I digress. Even though the car was hardly mine, the logic was that having signed up for a 24% interest credit card meant that I could have borrowed from the credit card, so didn’t need the student loan (interest rate: 3%). Sigh. I didn’t know. My dad hadn’t understood it would have limited my ability to seek future loans either. Had I been able to get the NO interest loan, it probably would have been even cheaper to buy the car than with the standard 3.99% financing or I could have used it to invest in stocks! Which was probably against the rules, but you know what I mean! Wanted: Financial Education.

Also, I was deemed “ineligible” for student loans because apparently, I had “too much money” at my disposal!! After I wrote a polite letter asking the loan office to justify why it was they thought I was rich, they cited a credit card that I had access to and that I had used it to buy a car! Well, all that was true, but it was my dad’s persuasion for me to take advantage of the student discount (a campaign by the credit card company) on some new GM model at the time. In that case, the car payment obviously came from him because the car was HIS. And at most I got to drive the car sometimes to go “clubbing” (night not baby seal) in the Canadian winters—it was the only way to participate in the mass cultural delusion that it is at all possible to be fashionable in the cold; an abject denial that cocoon-animal-hide-blubber insulation was truly the only physiologically sound way make it to Thursdays Ladies’ Night. But I digress. Even though the car was hardly mine, the logic was that having signed up for a 24% interest credit card meant that I could have borrowed from the credit card, so didn’t need the student loan (interest rate: 3%). Sigh. I didn’t know. My dad hadn’t understood it would have limited my ability to seek future loans either. Had I been able to get the NO interest loan, it probably would have been even cheaper to buy the car than with the standard 3.99% financing or I could have used it to invest in stocks! Which was probably against the rules, but you know what I mean! Wanted: Financial Education.

Anyhoo, long story short, even without student loans, I still got those oh-so-parchy parchments in the end. Some American friends in their 30s still live close-to-the-edge, with $11,000 in student loan and credit card debts, or with a $50,000 debt for having gone to Teachers College at Columbia for just one year and living away from home for a Masters Degree (I paid about $11,000 at the University of Toronto). They are unable to save. Whatever they make as working adults goes toward living expenses and servicing these debts. In Japan, we also use the term: the Working Poor.

If I can, I’d like to plant a few considerations in the window herb boxes of those planning on embarking on costly post-secondary education.

The Occupy movements have turned the floodlights (finally!) on the student debt crisis happening, mostly in the US. Quick low-down: to get a brand-named education, one year’s tuition can be over $10,000 USD, even $30,000 USD for Ivy League. In addition, living away from home can easily double those costs. So, unless they are rich, families of students probably re-mortgage their homes, in addition to taking out a complex scaffold of loans in order to gold plate their child’s brain.

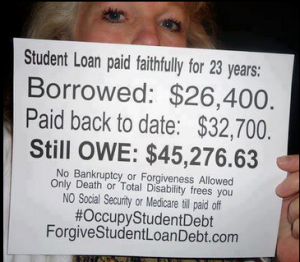

But upon graduation (or dropping out) when the loans become due, because of economic depression, personal problems, natural disasters or whatever, Harvard Law degree or state diploma notwithstanding, many students are unable to pay back the loan in due time and the Wailing Banshee of Compound Interest starts screaming in their ears. Apparently 2/3 of borrowers have trouble paying back their loans on time. There have been notorious cases of students’ $60,000 loan swelling to $262,000 because of interest over time! Or even the question of deceased students’ families having to continue assuming their debt. Meanwhile, the student loan industry remains one of the most profitable in the world (CEO of Sallie Mae earning $250 M in total) and also the most protected—all under the guise that they are “doing society a favour” by lowering a financial mercy ramp to the masses to be able to touch the toenails of higher education. (Ironically), for the sake of economic upward mobility!

Yet, there is no protection or real compassion for students in the true spirit of supporting young lives and the pursuit of education and better futures. Case in point: in the above case, of the $262,000 swollen debt, despite the student actually having eventually paid off the $60k (the principal), she is forced to forever be liable to pay off the $202,000 in interest, which will continue to grow if she is at all slow about it. Furthermore, the loan company had also been able to recoup the $60k from the government (=tax-payer money) by law because of legislation that insures these loans (all they had to do was complain that she probably defaulted). Worst of all: they are in addition legally allowed to forever chase after her for the $202k because they then “sold” her bad loan to a collection agency, so it has become a “separate” product. However, Sallie Mae, for example, actually owns these collection agencies too. So, in the end, by law, they get paid 3 ways. No wonder Elizabeth Warren, American bankruptcy expert, has said that this industry enjoys protection for their racket that even mobsters would envy. One aero-space engineering student who stopped paying off his loans altogether in protest added that he cannot get a job of any prestige (like aerospace engineer) because of his bad credit rating! Didn’t know that!

All this from a 60-Minute episode aired a few years back on the Student Loan Crisis: www.youtube.com/watch?v=B7OHrVKNIvw

Students! Yikes! I know that it is easy for me to sit here, degreed and older, telling you to:

Re-think the expense of education

(but check it out):

1. Do you really have to go to a brand-named university? What is the price difference between that and a cheaper local one that you will learn from just the same? Talk to some students who have been there and done that—what do they say? Online forums! While you’re online–think online courses or degrees! Do you really need to pay $40,000 for a Bachelor Degree–when this stepping stone can be gotten way cheaper? (It’s a commodity–think $10 coffee vs. $2 coffee).

2. Have you EXHAUSTED your search for possible scholarships and grants? Have you looked? Have you really tried applying properly? Look online, in local government offices; ministries of education; college bulletin boards in the admin office. Side note: minorities and women always have extra bursaries for them! Beware of strict deadlines! Mark them in your calendar and Rocky IV-montage it for the win!

3. Do you have to live away from home? Is your family that annoying? The savings on rent and food are enormous!

4. Can you bear sharing your housing? Have you looked into shared housing? Is it safe? Is it too far? Annoying? It’s a lot cheaper.

5. Are you smart enough and a hard-enough worker to handle going to school AND working a light part-time job? That helps.

6. 300 freshmen a year die of alcohol poisoning during Frosh Week, due to their inexperience with it. Not only your health, but it will also seriously suck your money dry if it becomes a habit. Alcohol is a diuretic in more ways than one.

7. Do you realize that there are TONS of graduates out of work? Even those with multiple degrees and YEARS of experience. What is the unemployment situation in your locality? Or in your field? What field are you interested in? Maybe your field is already over-saturated with graduates. I’ve read about Harvard Law School grads waiting tables! Does your dream job really require a particular degree from a particular university? Can you make your way in another way? Like, apprenticing / interning in such a field? Would you be better off learning a practical trade that has demand in the job market? In which case, a vocational or technical college would be more useful, perhaps? Be practical. (I knew a couple that got 2-year diplomas in Purchasing at a training college; they never went to university. They bought a house in their 20s).

8. Are you truly passionate about what you want to major in? If you are undecided, maybe it is worth it to take a year off, work at an easy job, save money and decide.

9. Is it possible to borrow money from your parents or trusted friend? Are you a trustworthy borrower? You will save so much money on interest!! (Unless your parents are bookies).

10. Are your parents pressuring you to leap into college without you really deciding for yourself? Are they financially literate? Have they considered the costs to them or to you? Real talk. Or is this some American Dream you guys are all chasing?

Things to consider if you end up having to apply for a loan:

11. What is the compound interest rate on your loan? What does that even mean?

12. When do you have to start re-paying the loan? What happens if you are late with your payments? What does the picture of a ballooning late loan look like? What is the worst-case scenario—how much would you owe for a loan that is late being paid off over 5 years after graduation? Do you even understand how this situation in the photo could happen? (btw, it’s normal!!! wtf indeed):

13. $#!& happens. What does your loan contract say if you were to die? Does your family have to take on the debt (some companies say no, some say yes)? What happens if you are struck with physical or mental illness and cannot work? Or get fired or laid off and cannot make loan payments? What does the fine print say?

14. Some loans may seem better / cheaper than others. But, understand what the difference is. Like, one loan seems to give you a lower interest rate for now, but may have stricter terms of you having to pay it back—and may even increase the interest rate later.

15. Research different loan companies WAY ahead of time. The rush to apply for loans makes people desperate and does not allow for proper thinking time.

16. Ask questions until you understand.

17. Is there insurance you can get to secure regular payments on the debt in the case of you having to take a hiatus, or drop out or be unemployed, laid-off or fired after you graduate? Are you the type to be able to keep up insurance payments? Is this option already included in your health insurance for health problems that may come up?

[UPDATE: billionaire Dallas Mavericks owner Mark Cuban blogged this EXCELLENT piece that all high school students NEED TO READ before choosing a college!]

I have benefitted a lot from my university education and it is the reason I have been able to find work after graduation. So, I can vouch for getting degreed if you want to be what I became: a teacher. But, I also stayed practical and in my field of Education, I didn’t chase after a super-brand-named university, but a good one nonetheless. I lived cheaply and at home where I could. I tried to work part-time. And I applied the heck out of scholarships. And I didn’t drink so much.

Jordan Goldberg

August 4, 2012

This is an informative post which is so helpful to me. Reading this post article I am really so impressed. I think this article is so helpful to me. A big thank for sharing such an informative post. Thanks and keep it up….

online student loans

Green Rabbit

August 4, 2012

I’m so glad someone actually got use out of it! 🙂